CPE credit, or continuing professional education credit, refer to the points earned by professionals who participate in specialized training in IT and other disciplines like Medicine, Accountancy, Law, etc. CPE credit is a requirement for specialized professionals that help them maintain or update their competency and skill set as professional service providers by upgrading or maintaining their credentials.

CPE credits are earned depending on the number of hours spent studying and are applied to certification programs. CPE programs vary in length, with some being brief and focusing on a general refresher of professional competencies or an overview of new technology, practice, or skill.

Who needs a CPE Credit?

Continuing professional education credits are required for all professionals, including doctors, accountants, IT professionals, realtors, lawyers, and others, to keep their licenses to practice actively. These credentials are offered to persons with talents ranging from entry-level to advanced senior levels and from established disciplines to new technologies, spanning many industries.

State-by-state CPE credit hour requirements differ, but the purpose is to guarantee that practicing professionals continue to learn and/or stay current with the newest advances in their fields of practice. Consider it professional growth time. Though each state’s Board of ‘specific regulating body concerning the discipline’ determines the exact amount of CPE credits required, in general, 50 minutes of professional training counts as one CPE credit regardless of which state you operate in.

How to earn a CPE Credit?

Training for continuing professional education credits is provided by industry associations, colleges, vocational schools, and private companies. These organizations frequently collaborate with colleges, trade schools, and businesses to assist professionals in obtaining CPE credit hours. E.g., (ISC)2 collaborates with security groups and technological entrepreneurs. Before beginning training, professionals should study the organization offering the credits to ensure that the credits will count toward their needed professional education.

CPE Credits can be earned online with on-demand webcasts and self-study programs. Using traditional instructor lead courses, continuing professional education credit can also be earned in a classroom setting. Professionals can also earn CPE credits by serving on industry boards, self-study, submitting an article in the field, and volunteering (such as mentoring a student). Professionals may also undertake a combination of these things to get the CPE credits.

Professionals in some industries can even earn continuing professional education credit by taking online quizzes. For example, as per Information Security magazine, security professionals can test their knowledge and earn CPE credit hours by taking quizzes in various information security fields, such as identity and access management (IAM), information security management (ISM), AI risks, and network security.

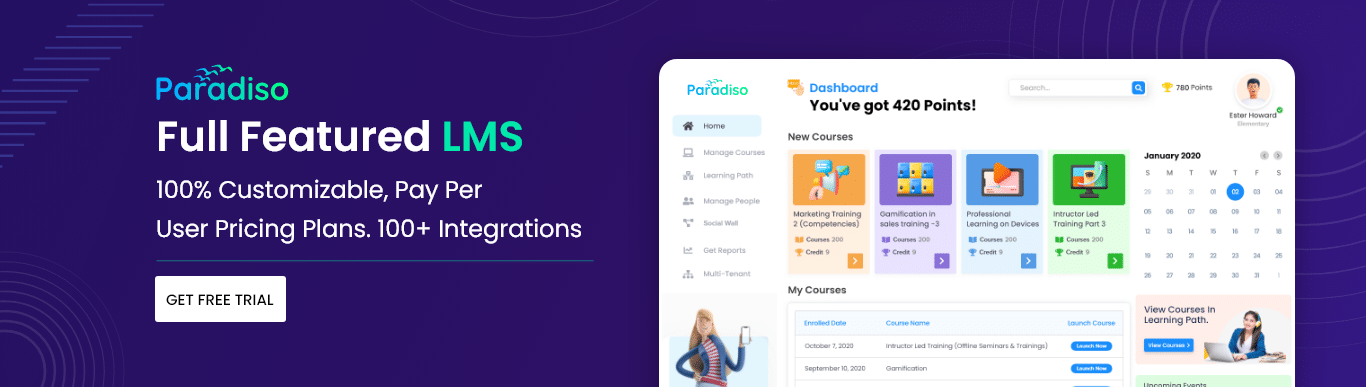

Professionals must get certificates from the person or approved organization hosting the course to receive CPE credit hours for their professional training. The State Board of ‘the responsible regulator for that profession’ has the authority to obtain copies of all CPE certificates to verify the learners’ (professionals’) compliance with the standards. Because they can do so at any time, it’s critical to keep track of all attendance certificates. Paradiso can assist you in keeping those individual certificates structured electronically, making them easier to locate and access if you need to generate a copy for the State Board.

What qualifies as CPE?

The number of CPE credits awarded is usually determined by the continuing education provided and how it is delivered. Training seminars, conferences, in-person and online classes, and webinars are all examples of CPE. Members must obtain continuing professional education credit through Qualifying Programs established by competent professionals, contributing to members’ competency and formally presented. Qualifying programs include in-house training programs, university seminars, conferences, trade exhibitions, and e-learning providers. The degree to which requirements are stringent varies by occupation.

How can professionals tell if their training qualifies for continuing education credits?

Before submitting their training activity for CEUs, professionals might use tools like the CEU (continuing education unit) assessment tool. This lets you see if the continuing education activity fits the program’s certification renewal requirements. It searches for information such as the completion date, paperwork, and content.

CPE Compliance

Professionals must adhere to all CPE requirements set forth by their state licensing authorities and other governmental, membership, and professional groups.

Members may enroll in and finish educational programs from non-state-approved providers in rare cases. Some of these hours may be qualified for CPE credits. To find out if non-approved programs can still award credits, members should keep all pertinent information and contact their state board.

Record-keeping and CPE Evidence

Members must keep accurate records of their continuing professional education credits obtained. This includes retaining documents and completing learning objectives.

Generally, CPE credits are equal to 50 minutes (though it varies as per the profession) of program time. However, state licensing agencies remind members/professionals that education and skill development should always take precedence over accumulating credits.

Document retention is necessary if regulators or other organizations seek proof of continuing education. It is in the member’s best interest to keep records for at least five years after the educational development program ends.

CPE requirements

The number of continuing professional education credits required vary by certification. IT professionals who hold ISACA certificates, such as CISA, CISM, CGEIT, or CRISC, must earn 120 CPE credits every 3 years, with at least 20 credits per year.

For Accounting professionals, the reporting period for AICPA begins on January 1 of the first full calendar year after joining. According to the AICPA, Certified Professional Accountants (CPA) must complete at least 120 hours of CPE for each three-year reporting period.

If members participate in programs that do not provide the number of hours, they can figure it out by multiplying the number of minutes spent on the program by 50. The number should be rounded to the nearest full hour.

Conclusion

Earning CPE credit is an important way to maintain your professional standing. The credits help you stay up-to-date on the latest changes in your field and ensure that you practice safely and ethically. The process of earning CPE credit can be daunting, but our overview provides a basic understanding of what you need to know. If you have further questions about earning or using your CPE credit, please contact us or consult with your state board or licensing organization.